It’s possible that he isn’t being credited for his work in years when the SSA’s system shows a name/SSN mismatch. If an employee expresses uncertainty about why the IRS is reporting a mismatch, you may wish to advise him to look into the issue. If the information on file and the information on the 1095-C that was flagged for a mismatch error are the same, the next step should be to speak with the employee to determine whether there’s an explanation for the IRS’s assertion that her name and SSN do not match. In that case, the first step is to verify what the employee listed on her original W-4 and any subsequent W-4s and check whether she submitted a copy of her Social Security card when you completed the I-9. Additionally, if an employee gets married or divorced and doesn’t change her name with the SSA but begins using a different name, there will inevitably be a mismatch. The published instructions for the 1095-C specifically reference SSN errors as a type of error that must be corrected.Īs a best practice, the first step is to check the form for typos and misspellings, which could be the cause of the error notification.

According to the IRS, all errors need to be corrected, and the 1095-C forms need to be refiled.

#1095 c form how to#

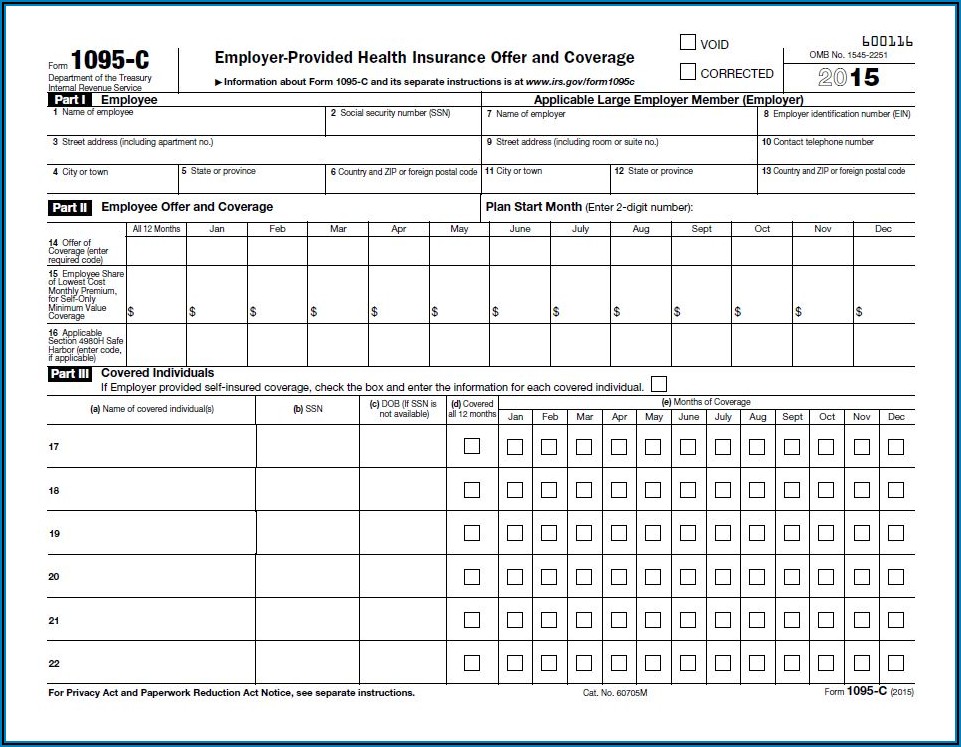

How to Respond to IRS Notification of a Mismatch on a 1095-CĪfter filing the 1095-C, some employers may receive an IRS notice indicating that the employee’s name and SSN do not match. Because that earnings history is the basis for determining an employee’s future eligibility and benefits amount for retirement, disability, and survivorship programs through the SSA, employees with valid SSNs should be incentivized to maintain accurate records with their employers. Once the W-2c is filed, the Social Security Administration (SSA) matches the name and SSN on each form against its database of all SSNs issued, and the corresponding lifelong earnings history for the employee is updated. The IRS recommends that if you receive a corrected SSN from an employee, you file a Form W-2c with a separate form for each year that needs correction. Maintaining a copy of the W-4 is a simple way to keep a record showing that you met the initial solicitation requirement. You should retain a record of the initial solicitation, any required annual or second annual solicitation, and the employee’s response to the solicitation, as well as a note or an annotation if the employee fails to respond. A second annual solicitation is required if you receive another IRS notice of an incorrect SSN for the employee the next year. If you receive an IRS notice about an incorrect SSN for an employee, you are required under the regulations to make an annual solicitation for the correct SSN by mail, telephone, electronic media, or in person. Because employees are required to furnish W-4s to the employer when their employment begins, the W-4 can be used for the initial solicitation of the employee’s SSN. Basic IRS Regulations for Solicitation of SSNsĪn employer is required to solicit an employee’s SSN at the time the employee begins work. Forms verifying offers of employer-provided health insurance and coverage for 2018 should be distributed in January 2019. Annual filing of the 1095-C form became mandatory for the 2015 tax year. To identify the employee for IRS purposes, Box 2 of the form asks for her SSN. The cost of the cheapest monthly premium the employee could have paid under the employer’s health insurance plan.The months the employee was eligible for coverage during the preceding year and.The IRS has specific procedures for making corrections when a mismatch occurs, and employers should implement best practices to appropriately address any mismatches and avoid potential penalties. Since that reporting requirement went into effect in 2016, you may have found yourself on the receiving end of an IRS notice informing you that an employee’s name and Social Security number (SSN) do not match. Under the Affordable Care Act (ACA), applicable large employers (ALEs) are required to file IRS 1095-C forms for their employees each year.

0 kommentar(er)

0 kommentar(er)